Real Asset Management (RAM) has a proven track record as a successful acquirer and manager of healthcare, essential services retail and commercial real estate. We manage 42 properties across Australia through the ASX listed RAM Essential Services Property Fund (ASX: REP) and an unlisted portfolios including the RAM Australia Healthcare Opportunity Fund, the RAM Australia Diversified Property Fund, and several Separately Managed Property Syndicates.

*Since inception, before performance fee – Investors should be aware that past performance is not indicative of future performance. Returns can change, reflecting rises and falls in the value of underlying investments.

A direct real estate manager with solutions across the risk spectrum.

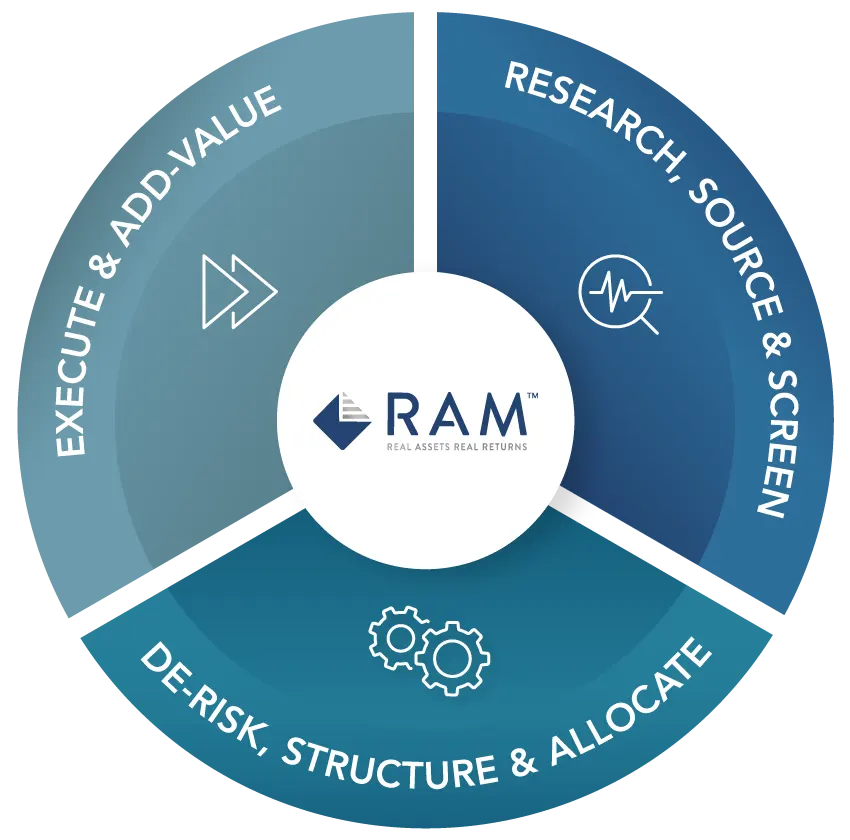

A dynamic, energetic and collegiate environment shaped to acquire, manage, de-risk and add-value through a balanced program.

Our three primary investment strategies provide core through to opportunistic returns on a risk-adjusted basis.

Why this sector?

Local Convenience Based Retail Assets

Why this sector?

Medical / Healthcare Assets

Why this sector?

Commercial Office Mandates

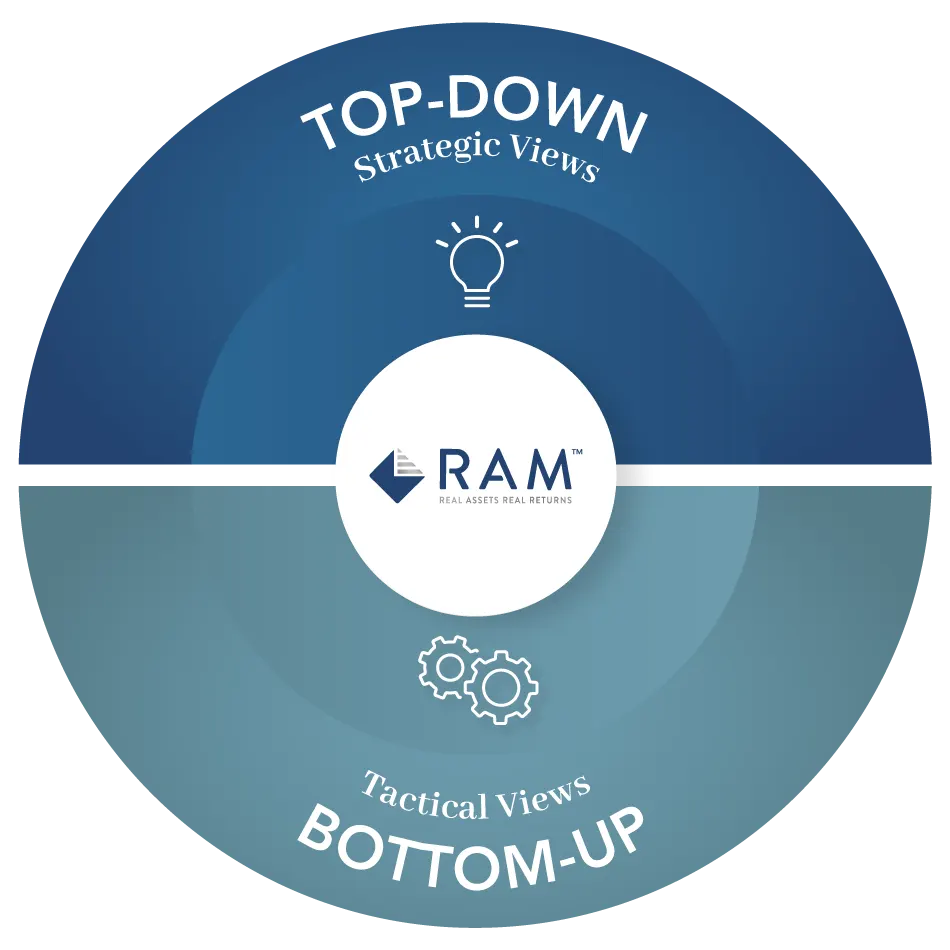

A top-down and bottom-up approach adopted for asset selection and risk tolerances that contributes to RAM’s longer term strategic and near term tactical views.

An investment in Real Assets is an investment in real tangible value. Real Assets are physical assets that have inherent scarcity such as real estate, infrastructure and agricultural land. Real Assets represent a compelling opportunity to capture attractive returns propelled by permanent long term structural changes in the global economy, such as urbanisation and the consumption growth of the middle classes in emerging economies.

Achieve effective portfolio diversification.

Increase your potential to achieve a consistent real return above that of inflation.

Enhance potential long-term returns by taking advantage of global trends.